Introduction

Risk management is not about expecting the worst, it’s being prepared for uncertainty. Every business, organization, or personal financial plan faces risks. The difference between success and setback often lies in how well those risks are anticipated and managed.

Planning for the “what ifs” allows you to respond proactively instead of reactively. Whether it’s economic uncertainty, operational disruptions, or unexpected life events, a strong risk management strategy helps protect your goals and ensures long-term stability.

What Is Risk Management?

Risk management is the process of identifying, assessing, and mitigating potential threats that could negatively impact your objectives. These risks may be financial, operational, strategic, or external.

Effective risk management doesn’t eliminate risk entirely. Instead, it helps you:

-

Reduce the likelihood of negative outcomes

-

Minimize potential damage

-

Make informed decisions with confidence

Common Types of Risk to Plan For

Understanding the types of risks you face is the first step toward managing them effectively.

- Financial Risks

These include cash flow shortages, market volatility, rising costs, or unexpected expenses. Without a plan, financial risks can quickly derail progress.

- Operational Risks

Operational risks arise from internal processes, systems, or people—such as technology failures, supply chain disruptions, or staff turnover.

- Strategic Risks

Strategic risks relate to long-term decisions, including entering new markets, launching products, or shifting business models without adequate analysis.

- External Risks

External risks include economic downturns, regulatory changes, natural disasters, or global events that are outside your direct control.

The Importance of “What If” Planning

“What if” planning forces you to think ahead and ask critical questions:

-

What if revenue declines unexpectedly?

-

What if a key team member leaves?

-

What if market conditions change overnight?

By modeling different scenarios, you gain clarity on your vulnerabilities and develop contingency plans before problems arise. This approach strengthens resilience and reduces panic during uncertainty.

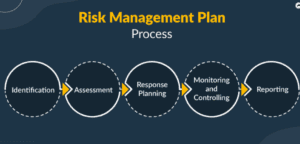

Key Steps in Risk Management Planning

1. Identify Potential Risks

Start by listing possible threats to your business or financial plan. Consider internal weaknesses and external pressures.

2. Assess Risk Impact and Probability

Not all risks carry the same weight. Prioritize risks based on:

-

How likely they are to occur

-

The level of damage they could cause

3. Develop Mitigation Strategies

For each major risk, create a response plan. This may include:

-

Building emergency funds

-

Diversifying income streams

-

Implementing insurance coverage

-

Strengthening internal processes

4. Monitor and Review Regularly

Risk management is not a one-time task. Regular reviews ensure your strategy stays aligned with changing conditions.

Risk Management in Business and Finance

In business, risk management protects profitability, reputation, and continuity. In personal finance, it safeguards income, savings, and long-term security.

Organizations that prioritize risk management are better positioned to:

-

Adapt to change

-

Maintain stakeholder confidence

-

Make strategic decisions under pressure

Similarly, individuals who plan for risk experience less financial stress and greater peace of mind.

Building a Risk-Aware Culture

Risk management is most effective when it becomes part of everyday decision-making. Encouraging open communication, transparency, and accountability helps teams identify potential issues early.

A risk-aware culture empowers people to:

-

Speak up about concerns

-

Think critically about decisions

-

Act responsibly in uncertain situations

Prepared, Not Fearful

Conclusively, risk management entails foresight and preparedness. Planning for the “what ifs” allows you to move forward with confidence, knowing you have strategies in place to handle uncertainty.

When risk is managed effectively, challenges become manageable, opportunities become clearer, and long-term success becomes more achievable.

Recent Comments