Effective financial management in business is crucial for ensuring the sustainability and growth of any organization. It encompasses a range of practices that help businesses allocate resources efficiently, minimize risks, and maximize profitability. In this blog post, we will explore the fundamental aspects of financial management in business, its importance, key components, and best practices to implement for achieving financial stability and success.

Partner has made a fraud in the contract of sale and being handed a cash and pen to the businessman signing the contract corruption bribery concept.

What Is Financial Management in Business?

Financial management encompasses the planning, organizing, controlling, and monitoring of financial resources to achieve business objectives. It’s the strategic approach to handling money that flows in and out of your business, ensuring you have the resources needed to operate efficiently while building wealth for the future.

Think of financial management as the GPS for your business journey. Without it, you might reach your destination eventually, but you’ll likely take costly detours and waste valuable time and resources along the way.

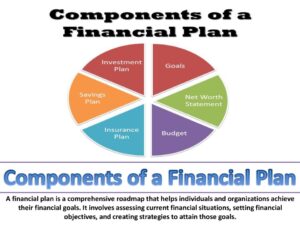

The Core Components of Business Financial Management

Cash Flow Management

Cash flow is the lifeblood of any business. Even profitable companies can fail if they can’t manage their cash flow effectively. This involves tracking when money comes in from customers and when it goes out for expenses, ensuring you always have enough liquidity to cover operational needs.

Key strategies include:

- Creating detailed cash flow forecasts

- Implementing efficient invoicing and collection processes

- Negotiating favorable payment terms with suppliers

- Maintaining adequate cash reserves for emergencies

Budgeting and Forecasting

A well-crafted budget serves as your financial roadmap, while forecasting helps you anticipate future financial needs and opportunities. These tools enable you to allocate resources strategically and make informed decisions about investments, hiring, and expansion.

Essential elements:

- Annual operating budgets with monthly breakdowns

- Rolling forecasts that adjust based on actual performance

- Scenario planning for different market conditions

- Regular variance analysis to identify deviations from plan

Financial Analysis and Reporting

Regular financial analysis provides insights into your business’s health and performance. Key financial statements—income statement, balance sheet, and cash flow statement—tell the story of your business’s financial position and help identify trends, opportunities, and potential problems.

Critical metrics to monitor:

- Gross and net profit margins

- Return on investment (ROI)

- Debt-to-equity ratio

- Current ratio and quick ratio

- Accounts receivable turnover

Working Capital Management

Working capital represents the short-term assets and liabilities that fuel daily operations. Effective management ensures you have sufficient resources to meet immediate obligations while minimizing the cost of holding excess inventory or extending too much credit to customers.

Essential Financial Management Strategies

Separate Personal and Business Finances

One of the most fundamental steps in business financial management is maintaining clear separation between personal and business finances. This separation provides several benefits:

- Simplified tax preparation and compliance

- Clearer picture of business performance

- Enhanced credibility with lenders and investors

- Better legal protection for personal assets

Implement Robust Accounting Systems

Investing in reliable accounting software and processes pays dividends in accuracy, efficiency, and insight. Modern cloud-based solutions offer real-time financial reporting, automated reconciliation, and integration with banking and payment systems.

Build Emergency Reserves

Financial emergencies are inevitable in business. Market downturns, unexpected expenses, or delayed payments from major customers can create cash flow challenges. Maintaining an emergency fund equivalent to 3-6 months of operating expenses provides a crucial safety net.

Manage Debt Strategically

Debt can be a powerful tool for growth when used wisely, but it can also become a burden if not managed properly. Evaluate debt based on its purpose, cost, and impact on cash flow. Good debt typically generates returns that exceed its cost, while bad debt drains resources without providing adequate benefits.

Technology and Financial Management

Modern businesses have access to powerful financial management tools that can streamline processes and provide valuable insights. Cloud-based accounting platforms, automated invoicing systems, and financial dashboard tools can significantly improve efficiency and accuracy.

Consider implementing:

- Automated expense tracking and categorization

- Real-time financial dashboards

- Integrated payment processing systems

- Automated recurring billing for subscription services

Building Financial Discipline

Successful financial management requires discipline and consistency. This means regularly reviewing financial performance, sticking to budgets, and making data-driven decisions rather than emotional ones. Establish monthly financial reviews where you analyze performance against goals and adjust strategies as needed.

Common Financial Management Mistakes to Avoid

Mixing Personal and Business Expenses

This creates confusion, complicates tax preparation, and makes it difficult to assess true business performance. Always maintain separate accounts and credit cards for business use.

Ignoring Cash Flow Projections

Many businesses focus solely on profitability while ignoring cash flow timing. A profitable business can still fail if it runs out of cash to pay bills and employees.

Inadequate Record Keeping

Poor financial records make it impossible to understand business performance, prepare accurate tax returns, or make informed decisions. Implement systems to track all financial transactions accurately and consistently.

Failing to Plan for Taxes

Tax obligations don’t disappear if you ignore them. Set aside money regularly for tax payments and work with a qualified accountant to ensure compliance and optimize your tax strategy.

When to Seek Professional Help

While many financial management tasks can be handled internally, certain situations warrant professional assistance:

- Complex tax situations or significant tax liability

- Seeking external funding or investment

- Preparing for business sale or acquisition

- Implementing new accounting systems or processes

- Facing financial distress or restructuring needs

Taking Action: Your Next Steps

Financial management isn’t a one-time activity—it’s an ongoing process that requires attention and refinement. Start by assessing your current financial management practices and identifying areas for improvement.

Immediate actions you can take:

- Audit your current systems – Review your accounting processes, banking arrangements, and financial reporting practices

- Create or update your budget – Develop realistic financial projections based on historical data and future goals

- Establish regular review cycles – Schedule monthly financial reviews to track performance and adjust strategies

- Build your emergency fund – Begin setting aside money for unexpected expenses or revenue shortfalls

- Separate personal and business finances – If you haven’t already, open dedicated business accounts and obtain business credit cards

The Long-Term Perspective

Effective financial management is about building a foundation for long-term success. While it may seem like extra work in the short term, the insights and control you gain will pay dividends as your business grows. Companies with strong financial management practices are better positioned to weather economic storms, take advantage of opportunities, and achieve sustainable growth.

Remember, financial management is not just about keeping the lights on, it’s about creating the financial strength and flexibility needed to pursue your business vision. By implementing these strategies and maintaining financial discipline, you’re investing in your business’s future success.

You can read more on financial strategies here

Recent Comments